Australia’s small businesses are powering ahead with optimism, resilience and discipline, however, mounting pressures on costs, wellbeing and consumer trust are testing their staying power.

Thryv® Australia’s provider of the leading small business marketing and sales software platform, has released its 2025 Business and Consumer Report for Australia, a landmark survey of 1,023 small business decision-makers and 953 consumers.

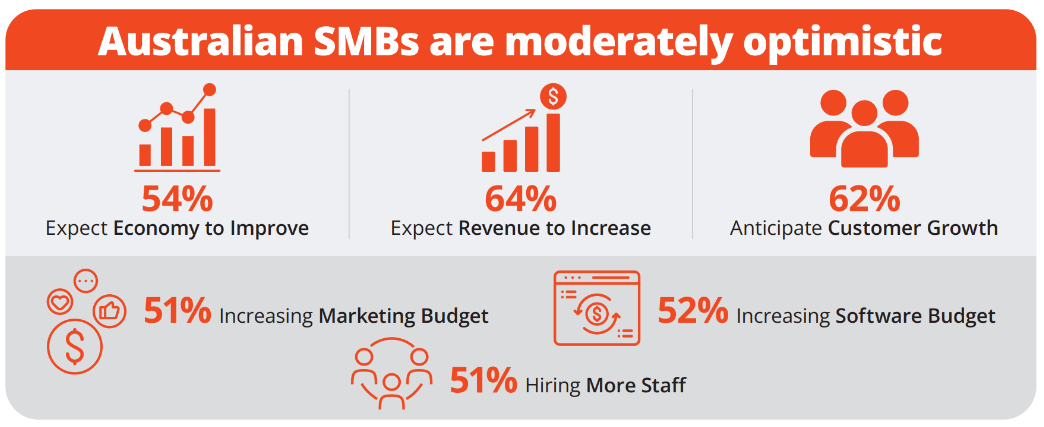

The findings reveal steady confidence and resilience across Australia’s Small Medium Business (SMB) sector, despite headwinds. Businesses are recording revenue growth, with 57% reporting increased revenue over the past year and 53% improving profit margins, while 64% expect revenue to rise and 62% anticipate further customer growth in the next six months. At the same time, rising input costs, wage pressures and payment delays are squeezing margins.

At the demand end, 42% of Australian consumers say they are likely to choose another business if key digital tools such as online ordering, booking or mobile-friendly websites are not offered, signalling a clear expectation gap for those not keeping pace.

Optimism anchored in discipline

Australian SMBs are displaying measured confidence grounded in real performance.

More than half (54%) believe the economy will improve over the next six months, 64% expect revenue to increase and 62% anticipate customer growth.

Elise Balsillie, Head of Thryv Australia and New Zealand, said this optimism reflects confidence built on experience, not risk.

“Australian SMBs are showing steady confidence and tenacity. They are growing revenues, investing in technology and hiring, however doing so with discipline. This is growth built on data and hard-earned lessons,” Elise said.

According to Elise, this cautious posture is both a strength and a challenge.

“It protects businesses in volatile times, however, over-caution risks missing opportunities when the market moves. Consumers are signalling clear priorities – 69% citing customer service as the key loyalty driver, followed closely by product quality and price (66% each). Businesses that channel investment into service consistency and customer experience will strengthen credibility and stand out,” Elise said.

Investment and hiring intent

The study also reveals encouraging signs of future investment. A majority of Australian SMBs are planning to increase their marketing (51%) and software budgets (52%) over the next six months, signalling confidence to compete harder in 2026.

Hiring intent is also solid. Nearly 43% increased staff over the past year and 51% expect staff numbers to rise in the next six months, with only 3.8% anticipating reductions, underscoring confidence in future demand.

“Australian SMBs are signalling intent to invest in their future,” Elise said.

“More marketing spend, higher software adoption and recruitment plans all point to businesses being ready to compete harder and smarter in 2026. However, intent needs to translate into customer alignment – from clear online communication to maintaining accurate reviews and digital listings, which consumers increasingly rely on to choose who they buy from.”

Costs and margin squeeze

However, the optimism is tempered by rising costs. 71% report increased costs of goods, 67% have raised their own prices, and 17% have seen payment times increase significantly with a further 34% reporting somewhat longer waits.

“Revenue without profit is momentum without progress,” Elise said.

“Business owners are working harder to achieve growth, however higher costs and slower payments are eroding profitability. It is the quiet squeeze that makes every decision harder. Consumers are equally cautious – 57% of Australians say higher prices deter them from buying, while 37% cite limited product range and 40% say inconvenience impacts their choice. In this environment, transparency and service quality become decisive.”

Service credibility gap

The 2025 Thryv Business Index and Consumer Report also exposes a sharp credibility gap between SMBs and their customers. While 45% of SMBs believe they deliver consistently high service, only 25% of consumers agree. Similarly, 33% of SMBs completely agree they offer a seamless customer experience compared with 20% of consumers.

“Australian businesses believe they are delivering strong service, however, consumers are less convinced,” Elise said.

“Friendly and responsive communication, which 63% of Australians cite as a trust driver, matters as much as price or product. When price pressures are real, service credibility becomes proof, not promise. SMBs that match their self-belief with consistent, responsive experiences will convert caution into loyalty.”

A similar disconnect is evident in digital confidence. While 72% of Australian SMBs believe they have a strong online presence across their website, social media and reviews, only 49% of consumers agree.

That gap represents lost loyalty and a missed opportunity. When prices are rising, service credibility becomes the single most important proof point, with 69% nominating customer service as a key reason to return. Consumers are also clear about what earns their trust: 64% are likely or very likely to leave a review after a purchase, yet only 38% of businesses consistently request them and 45% respond. Businesses that engage authentically with reviews will set themselves apart in a trust-sensitive market.

“Consumers are saying, ‘meet me in my inbox.’ With 57% of Australians preferring email for communication, businesses still relying on phone calls or social media are missing the mark.” Elise said.

Burnout and wellbeing

According to the 2025 Business Index and Consumer Report, workload remains a serious concern. 45% of Australian business owners have considered stepping away due to burnout or workload pressures. Businesses cite managing costs (48%), acquiring new customers (47%) and work-life balance (46%) as their top pressures.

“Burnout is no longer an isolated issue as it threatens succession planning, job security and the continuity of local services. We have to treat wellbeing as an economic factor, not just a personal one.” Elise said.

“From a consumer’s perspective, burnout shows up in slower response times or inconsistent service and that is when loyalty starts to fray. Investing in people’s wellbeing is investing in customer experience.”

Financing dynamics

Australian SMBs are using finance strategically to support growth.

40% have sought new financing in the past six months, with 90% of those applications successful, and 64% say access to finance is now easier when compared to six months ago.

Preferred options are personal savings (41%), bank loans (40%), credit cards (33%) and overdrafts (24%), highlighting both resilience and the personal stakes owners carry.

“The ability to access finance more easily is a positive signal,” Elise said.

“However, reliance on personal savings as much as bank credit reflects the pressure owners feel to underwrite growth themselves. Capital used well, especially for digital tools and service improvements, can be the difference between treading water and compounding advantage.”

Digital adoption and the expectation gap

Australia’s SMBs are leaning into digital tools, however consumers are moving faster.

On the business side, 41% offer online booking, 36% have mobile-friendly websites, 33% run online stores and 45% use social media updates, with only 13% offering none of these features.

On the consumer side, 43% expect online stores, 43% expect online booking and 42% expect mobile-friendly websites from small businesses. Nearly one in two (42%) are likely to choose another business if these core digital features are missing.

Awareness of support is still patchy, with 52% of SMBs aware of government or industry programs for digital adoption, leaving a substantial opportunity untapped.

“Tech confidence has to translate into execution,” Elise said.

“Consumers expect seamless digital experiences and that is a direct signal: digital ease is now part of basic service, not an optional extra.”

Significance of the study

The 2025 Thryv Business Index Consumer Report is the first dataset in Australia to pair business sentiment with consumer expectations. With more than 2,000 voices surveyed nationwide, it sets a benchmark for confidence, credibility and growth.

“We see optimism and serious intent to invest, however we also see exactly where consumers remain unconvinced. When 63% say friendly communication builds trust, 71% regularly check or value reviews, and 42% are prepared to move on if digital basics are missing, the message is clear. Service credibility, digital alignment and owner wellbeing together will decide which Australian small businesses turn resilience into enduring growth.” Elise said.

State Results at a Glance

| State | Revenue confidence | Top pressure | Profit and cost reality | Owner strain signal | Key insight |

| Queensland | 62% expect revenue to rise | Rising wages (75%) | 49% report profit margin growth; wages up 67% | 40% have considered stepping away from the business | Strong growth expectations, however wage and input cost pressures are tightening margins |

| New South Wales | 55% expect growth | Cost of goods (69%) | 49% report profit margin growth; wages up 64% | 42% have considered stepping away from the business | Confidence remains steady, yet cost pressures are tempering profitability and resilience |

| Victoria | 55% expect growth | Rising wages (68%) | 55% report profit margin growth; cost of goods up 71% | 49% have considered stepping away from the business | The highest burnout risk nationally, signalling pressure on sustainability despite profit growth |