As the end of the financial year approaches, a leading business finance expert is warning that a Tax-Driven Decision rushed effort to reduce the amount of tax paid by a business could prove damaging in the long term.

Grow Capital CEO Gus Gilkeson says while there’s nothing wrong with making decisions and asset purchases that result in a tax advantage, the danger exists when businesses make decisions based on tax implications first.

“When making an investment in your business – whether that be the purchase of a new asset or securing finance – the first consideration should always be ‘how does this support my long-term strategy for growth and/or income?’.”

“The taxation aspect of that investment should be secondary, but unfortunately we see too many people making poor investment decisions based on avoiding paying tax in the short term.”

Examples of these, says Mr Gilkeson, include equipment or assets that are substandard, unfit for purpose, or have high maintenance costs.

“You need to ask yourself, is it worth claiming a tax deduction this financial year, if it’s not going to offer a solid return on investment going forward.”

With the Federal Government reducing the $20,000 instant asset write off to $1000 from July 1, Mr Gilkeson says businesses may be tempted to make big purchases before June 30.

“Again, I would urge that business to consider whether the hit to cash flow and any ongoing costs associated with the asset are worth the tax deduction this year. Is it really a saving if you end up paying more in future years?”

Mr Gilkeson offers this advice to avoid tax driven decision.

- Don’t Rush: Making decisions in a hurry to beat a deadline – including the end of a particular program or scheme – is never a good idea, says Mr Gilkeson. “If you have to rush, then chances are you haven’t done your due diligence. If your ducks aren’t in a row and you miss out, then that’s a lesson learned for next time. But there’s no point rushing into a bad decision that costs you down the track.”

- Consider Your Options: If tax minimisation is a focus, consider all your options, including research and development investments and/or offsetting, for example.

- Look at the Big Picture: Always consider your longer-term business strategy and goals, and how the current decision fits into that.

- Expert Advice: Mr Gilkeson says professional, objective advice is always best. “Whether it be your broker, financial adviser or accountant, seeking professional advice ensures you’re aware of all the potential risks and gives you a fresh perspective on whether the investment is worth it in the long run. Professional advice is also tax deductible.”

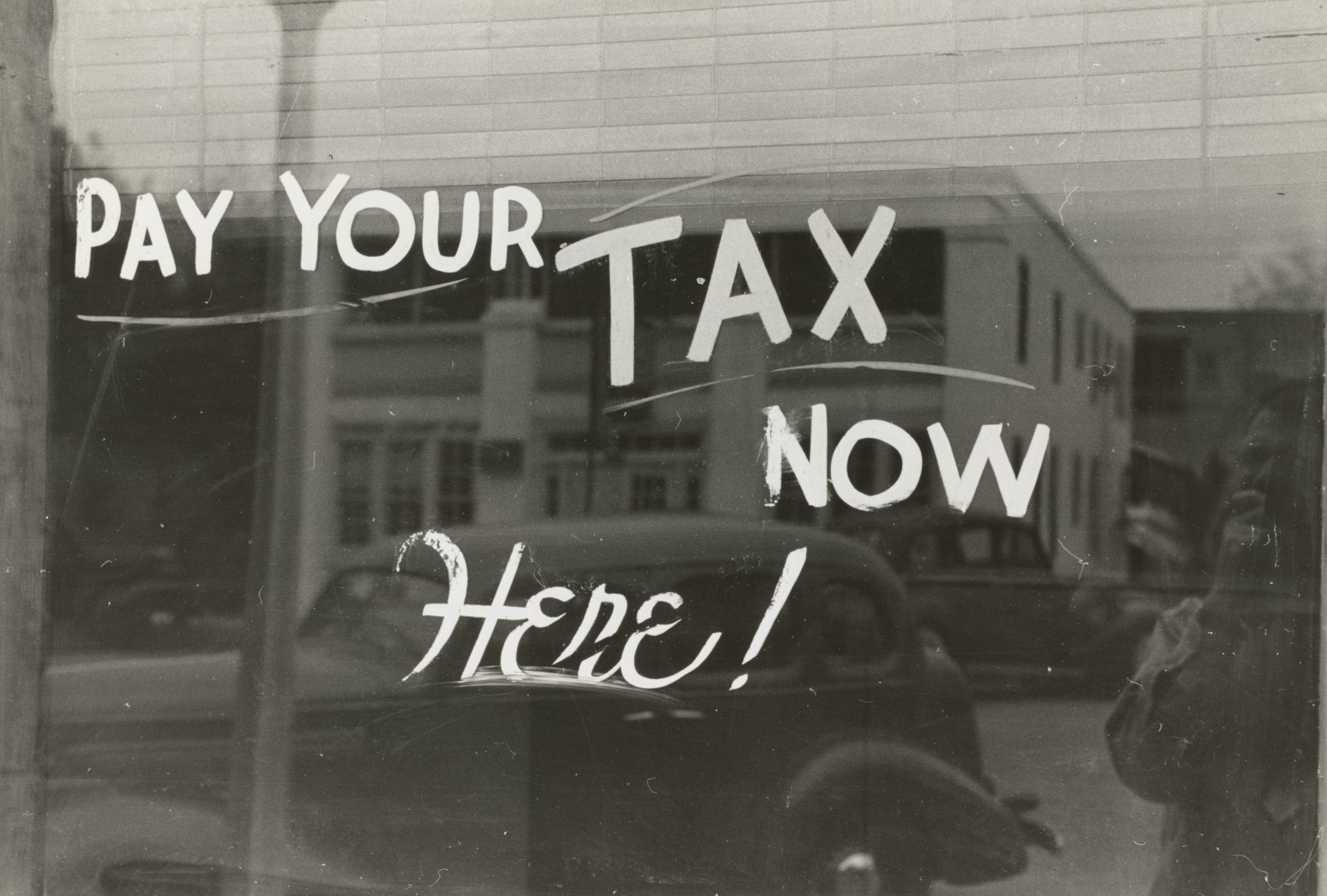

Australia’s Commissioner of Taxation recently confirmed the ATO’s debt book is more than $105 billion, a number Mr Gilkeson says highlights Australians’ broader attitude to paying tax.

“I think it’s fair to say that Australians collectively don’t like paying tax, but it’s a cultural mindset that really needs to change.”

“Is paying tax really a problem? It’s absolutely important that there are checks and balances to ensure SMEs aren’t paying too much tax, but if a business is focusing only on tax minimisation or trying to avoid paying tax at all, then I would suggest their priorities are all wrong.”