Chartered Accountants Australia and New Zealand (CA ANZ) urges Australian small businesses to review their tax and cash flow strategies ahead of a significant change to tax deductibility rules that could cost them thousands if they have a tax debt.

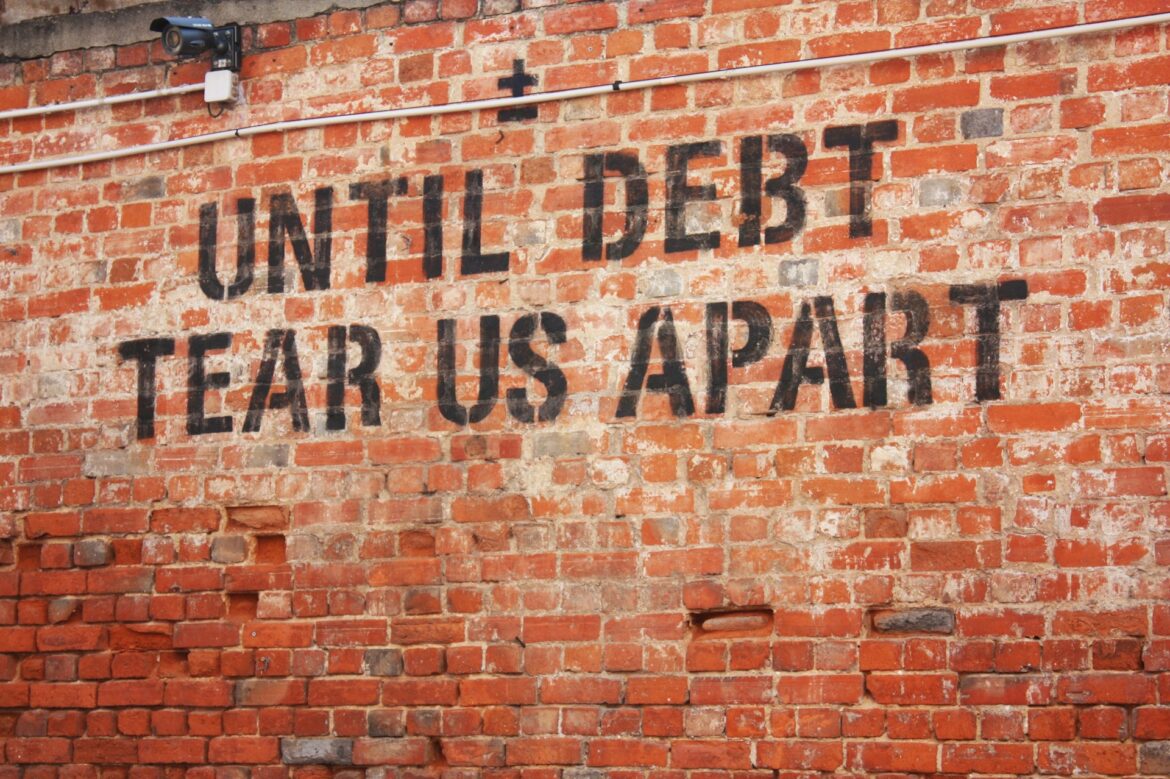

From 1 July 2025, interest charged by the Australian Taxation Office (ATO) on late tax payments – currently set at 11.17% and compounding daily – will no longer be tax deductible.

CA ANZ Tax Expert Susan Franks warns this change will substantially increase the real cost of falling behind on tax obligations, particularly for small businesses already operating on tight margins.

“Small businesses currently hold the majority of the ATO’s outstanding tax debt, and this change will make that debt even more expensive,” said Ms Franks.

“We’re encouraging all small business owners to speak with their accountant now to avoid being caught out when the financial year ends.”

With more than $45 billion in tax debt owed by small businesses, the stakes are high.

“The interest on tax debt that’s payable to the ATO compounds daily.

“Previously, small businesses may not have been concerned about accumulating interest on tax debt, as it was deductible at tax time.

“But from 1 July 2025, small businesses could find themselves in a difficult situation and if not managed carefully, interest owed to the ATO could quickly exceed the amount of tax they were originally meant to pay.

“Chartered Accountants can help small businesses with cash flow to ensure that expensive debt, such as tax debt, is minimised.”

CA ANZ also warns that traditional lenders are often reluctant to finance businesses with existing tax debt, making proactive cash flow management more critical than ever.

Five Key Tips from Chartered Accountants to Help Small Businesses Prepare for the upcoming change:

- Know and monitor your cash flow

Understand when your tax is due and align it with your incoming payments. Planning ahead is essential. - Get paid faster

Automate invoicing, offer flexible payment options and consider debt factoring to improve cash flow. - Cut unnecessary costs

Review expenses such as energy, insurance, and inventory. Negotiate better terms and eliminate waste. - Review your pricing

Ensure your pricing reflects rising costs and that you’re focusing on profitable, reliable customers. - Explore alternative finance

Interest on bank loans and overdrafts remains deductible and may be cheaper than ATO interest.

“Chartered Accountants are here to help small businesses navigate these changes,” said Ms Franks.

“With the end of the financial year approaching, now is the time to act.”

For more information or to speak with a chartered accountant, visit www.charteredaccountantsanz.com.