The Xero Small Business Index fell just one point in May 2022 to 124 points, as wage growth and

payment times slow

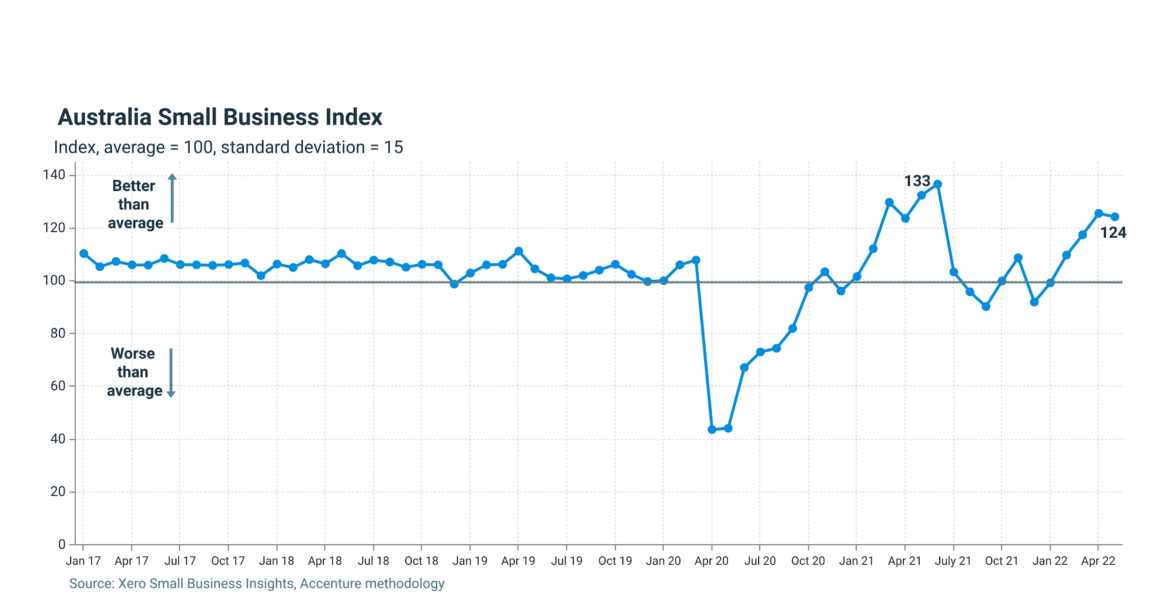

Xero, the global small business platform, today released its latest data on the health of Australia’s small business economy during May from the Xero Small Business Index. Based on aggregated and anonymised transactions from hundreds of thousands of small businesses, the Index, developed in collaboration with Accenture, is part of the Xero Small Business insights program.

Xero’s Small Business Index fell only one point in May 2022 to 124 points. While small business jobs increased 0.3 percent year-on-year (y/y) and sales growth rose to double digits (10.8% y/y) these results were offset by slower wage growth and longer payment times. However, even after a challenging start to the year, small businesses have recorded four months of above-average performance.

Joseph Lyons, Managing Director Australia and Asia, Xero, said: “It’s promising to see an increase in jobs. While the data indicate only small growth, we know that any and all support for small businesses is important. It’s been an ongoing challenge for many to find talent, hampering their ability to fully recover – we all know a restaurant or cafe that’s struggled to open its doors due to a lack of staff. We hope to see this growing jobs trend continue as Australia gradually welcomes new talent from overseas and expands the labour pool.”

Small business records moderate jobs growth

Small business jobs grew 0.3 percent y/y, a small but positive result after two months of declines. The largest job growth was recorded in the administrative and support service industry (4.5% y/y), while education and training continued declining for the ninth consecutive month at 5.0 percent y/y. “While jobs remain soft, this is a welcome break following a trend of slower and falling job growth over the past seven months. Ongoing high levels of job advertisements indicate supply remains the issue, with demand for more workers clearly there as small businesses continue to compete for staff,” says Louise Southall, Economist, Xero.

Cost of living impacting discretionary spending industries

Sales rebounded in May increasing to 10.8 percent y/y, up from 8.3 percent y/y in April, due to a combination of rising prices and higher sales. Along with the largest jobs growth, the administrative and support service industry also recorded the highest sales result at 20.4 percent y/y.

However, with the cost of living pressures rising, discretionary spending-based industries including hospitality (2.8% y/y) and information media and telecommunications (6.4% y/y) saw softer results.

“With inflation continuing to rise, this result was expected as Australians reduce discretionary spending and focus on necessary purchases. Consumers are becoming more pragmatic due to the combination of increasing prices and only modest wage growth. This can be seen in the weaker sales results for the hospitality, information media and telecommunication industries,” said Southall.

Wage growth slows, impacting all industries

Wages slowed in May to 3.7 percent y/y from 4.3 percent y/y in April, impacting all industries and regions. Transport recorded the slowest growth at just 2.9 percent y/y, followed by arts and recreation at 3.0 percent y/y. This result comes as a surprise, given that the tight labour market should be pushing wages higher.

“The surprise decline in wages in May, coupled with the soft jobs results in recent months, suggests small businesses might be struggling to compete with larger businesses to find the staff they need to keep growing,” said Southall.

To download the full May results, including industry and regional breakdowns, go to the website here.